US DOJ Seizes Over $8 Million in Cryptocurrency Tied to ‘Romance Baiting’ Scams

- American authorities managed to seize over $8 million in crypto in an operation targeting “romance baiting” scams.

- Cybercriminals convinced people to invest large amounts via fraudulent platforms.

- The DOJ and the FBI are actively tracing accounts linked to the stolen funds to identify additional victims for restitution.

The U.S. Department of Justice (DOJ) recently announced the seizure of $8.2 million in cryptocurrency linked to a sophisticated “romance baiting” scam. The operation defrauded victims by soliciting investments into fraudulent platforms, ultimately leading to a massive financial loss.

These scams targeted individuals under the guise of romantic or emotional connections. Scammers manipulated victims into investing in seemingly profitable platforms that offered fake returns to build trust.

Over time, victims were persuaded to invest larger amounts, only to be blocked from withdrawals with fabricated excuses like "taxes" or "release fees." By the time victims realized the platforms were fraudulent, the funds had already been funneled into the wallets of the scammers.

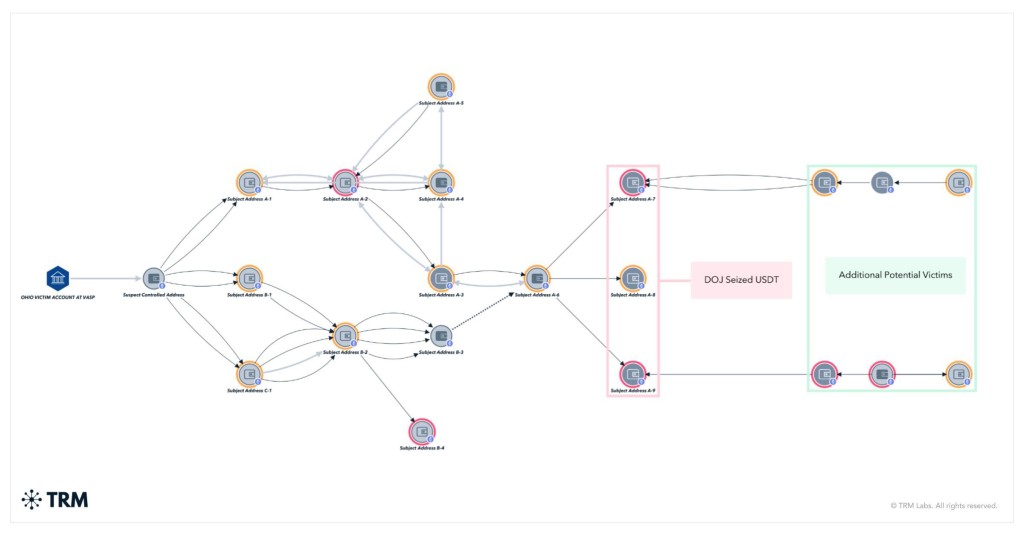

The FBI, in collaboration with blockchain intelligence platform TRM Labs, uncovered laundering methods tied to the scam. Investigators established a dual legal forfeiture case – wire fraud for directly traceable funds and money laundering for commingled or untraceable funds.

These legal designations allowed the DOJ to fully seize the identified assets. Tether Limited, the issuer of the USDT cryptocurrency involved, played a critical role by freezing the stolen funds, burning the tokens, and reissuing them to wallets controlled by law enforcement.

The investigation confirmed 38 victimized cryptocurrency accounts tied to losses exceeding $5.2 million. Victims included individuals from Ohio, California, Michigan, Utah, and North Carolina, with identified losses ranging from several thousand to over $600,000.

The funds of over 30 identified victims were routed through DeFi platforms, cross-chain swaps, and unhosted wallets and ended up in three TRON addresses.

Investigators believe the criminal operation is linked to human trafficking syndicates operating in Cambodia and Myanmar. These organizations are known for employing coercion and exploitation to sustain their fraudulent schemes.