‘Pay to Get Paid’ Job Scams Are on the Rise, Costing Victims Millions

- Scammers manage to steal people’s money via fake job opportunities involving apps or products.

- These fraud campaigns leverage unsolicited job offers sent via social media that involve simple tasks with big payouts.

- Most of these false jobs involve illegal activities such as boosting content visibility or ratings, which disguises the true intent of the scam.

A new and increasingly prevalent job scam known as "pay to get paid" is stealing victims’ funds. Labeled as “task scams” or “gamified job scams,” these deceptions exploit unsuspecting job seekers, enticing them with promises of simple tasks and enticing payouts.

This particular fraud follows a manipulative formula. Victims often receive unsolicited job offers via text or private messaging for vague roles involving “app optimization” or “product boosting,” McAfee’s latest report says.

After setting up accounts on fake platforms, victims are tasked with activities like liking videos or rating product images.

While initial payments from the scammers create a facade of authenticity, the trap is sprung when victims are asked to pay deposits to unlock “higher-paying” tasks. Ultimately, both the promised earnings and their deposits vanish with the scammer, leaving victims defrauded.

Critical factors that make this fraud particularly insidious are the illegality of the task and cryptocurrency payments.

Most of these false jobs involve activities that are flagged as illegal, such as boosting content visibility or ratings, which disguises the true intent of the scam.

Many fraudsters prefer cryptocurrency for deposits, as it is harder to trace and recover, contributing significantly to the rising losses in fake job cases. Victims lose more money to scams utilizing cryptocurrency rather than traditional payment methods.

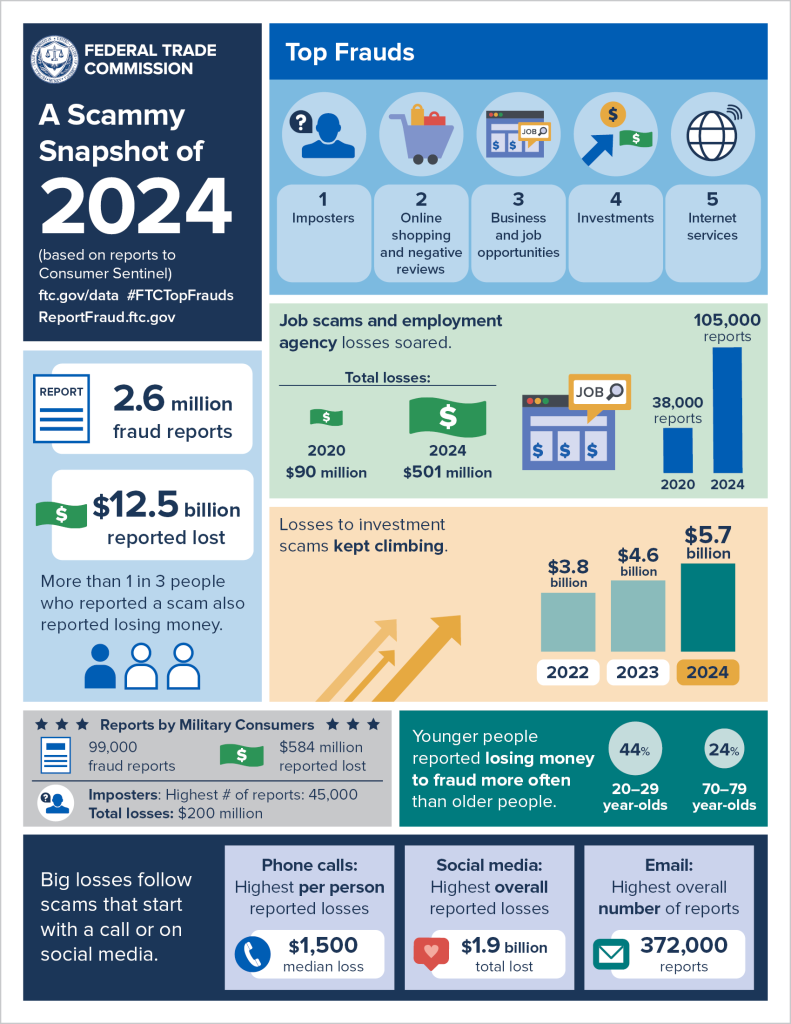

According to data from the FTC, job scam reports nearly tripled from 2020 to 2024, with financial losses skyrocketing to a staggering $501 million last year alone.

Job seekers can protect themselves from these deceptive schemes by avoiding job offers sent via text or social media (e.g., WhatsApp), researching the company offering an unsolicited job before engaging, and refusing to pay upfront.

By avoiding high-risk behaviors such as submitting deposits or interacting with vague online entities, potential victims can reduce their likelihood of being defrauded.