Netflix Actual Global Growth Shows First Definitive Signs of Stagnation

- Netflix’s growth was well below the predicted one, and this is the first sign of market fatigue.

- The company believes they can turn things around in the upcoming trimester with a new service.

- Disney Plus is closing in, and the competition is rising to the point that makes customers far more selective.

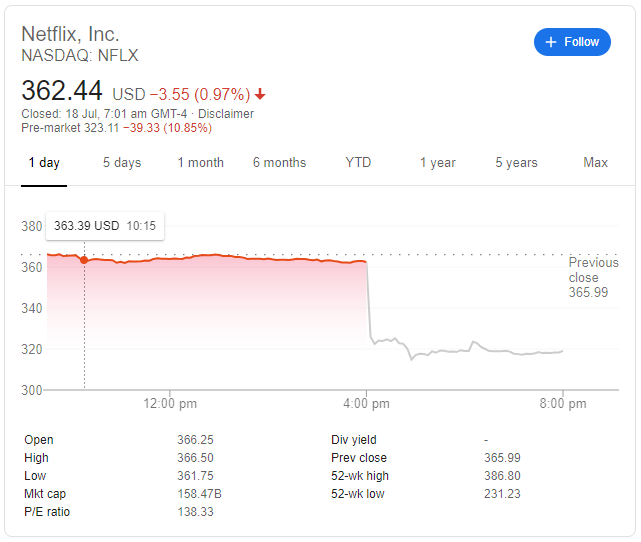

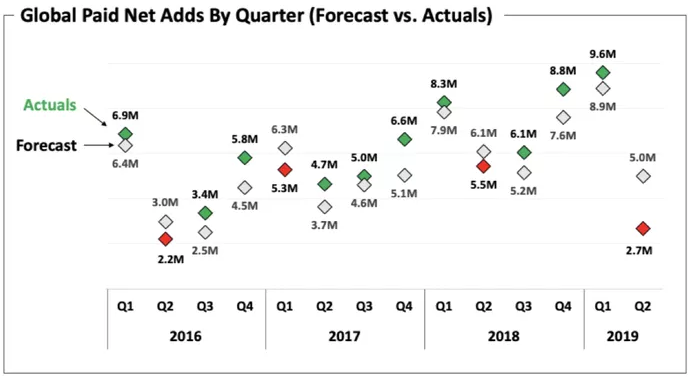

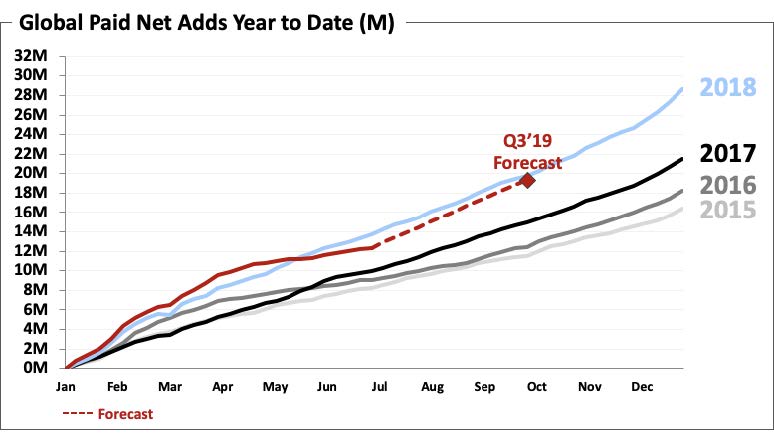

It looks like Netflix’s growth has just hit a wall, as this is the first time that the streaming platform and content creator has announced the number of the new customers they got between April-June (2.7 million subscribers), and they are well below the expectations announced to the shareholders previously (about 5 million). In the US, Netflix lost 130000 subscribers. As a result, the Netflix share value dropped from $362.5 down to $315 today, which shows that the worries have just started. To make things worse, the total revenue figures show a natural increase, but the net income fell from $384 million in Q2 2018 to $270 million in Q2 2019.

This comes at a time when Apple’s and Disney’s breath is so close that Netflix can feel it on their neck, so they got to keep going strong if they want to compete with the competition that’s coming. Netflix is trying to free up more resources with which they will produce more original content, but there’s only so much they can do about this. For this reason, they recently bumped up the prices of their subscription plans in the US, UK, Latin American countries, and Caribbean-based users. On all of these markets, Netflix discovered a negative development, so this price rise was the wrong move to do. However, that is not to say that regions that didn’t have a price hike came anywhere close to the predictions, but the numbers were not as far off as in the US, UK, and Latin America.

image source: sec.gov

In spite of all that, Netflix is confident that the Q3 is going to be a lot different story, expecting to add 7 million new paid memberships. Part of the reasons behind this optimistic prediction is that they are planning to launch a new “mobile-only” service that will start in India and will be available at a lower cost than any other plan. This new plan will only offer video stream quality of 480p, so whether people are still hot for such a definition and consuming media on tiny screens or not remains to be seen.

image source: sec.gov

Will you be subscribing to Netflix later this year, renewing your plan, or canceling it? Let us know in the comments down below, or discuss your intentions with our community on our social media, on Facebook and Twitter.