“MyPayrollHR” Exit-Scams and Captures $35 Million From Clients

- Payroll management firm “MyPayrollHR” has found a way to grab millions from its clients’ employees.

- The firm’s CEO has vanished, while all of its employees are unresponsive, and the website is down.

- The banking account of the company has been frozen now, and no transaction reversals are possible.

New York-based payroll firm “MyPayrollHR” has suddenly decided that it was time to cease operations, catching 4000 companies that trusted them by surprise. This unexpected development resulted in the capturing of $35 million, an amount that was meant to cover the upcoming payroll and taxes for MyPayrollHR’s customers. This amount is not in the pocket of the payroll management firm yet, but in a legal limbo that underpins frozen bank accounts, making it very hard for its rightful owners to claim back.

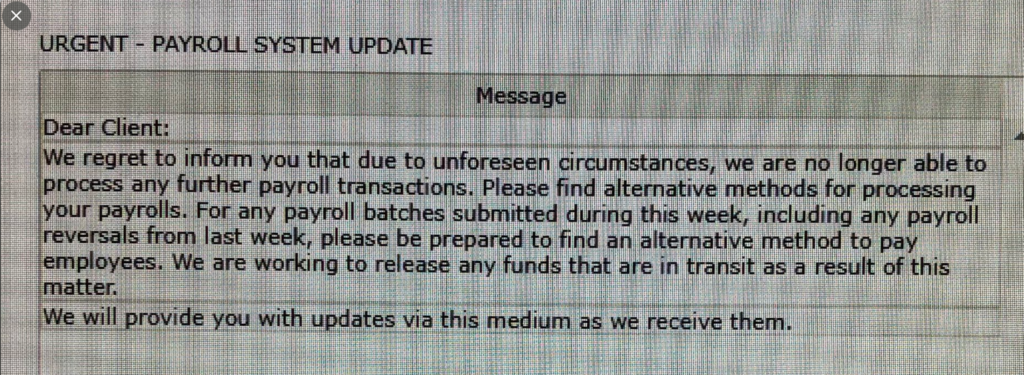

MyPayrollHR circulated an urgent notice to its clients, informing them that due to unforeseen circumstances, they are no longer able to process any payroll transactions. The message also urges the recipient to find alternative methods. In the meantime, the bank accounts of the employees have been debited for a month’s worth of wages, which shouldn’t have happened if the intentions of the payroll firm were honest. Closing your doors and grabbing a month’s wages from employees whose employers used MyPayrollHR certainly doesn’t look right.

Source: krebsonsecurity.com

According to more details provided by KrebsOnSecurity, MyPayrollHR has ordered their collaborator, Cachet Financial Services, to send all of their clients’ payroll to a single account that they controlled. Although this had never happened before, Cachet performed the single transaction of $26 million that ended up in MyPayrollHR’s account in Pioneer Savings Bank. This bank account is now frozen, and Cachet is in the process of reversing the transaction. With so many employees now having their bank accounts on the red, chaos has spread in the affected workplaces.

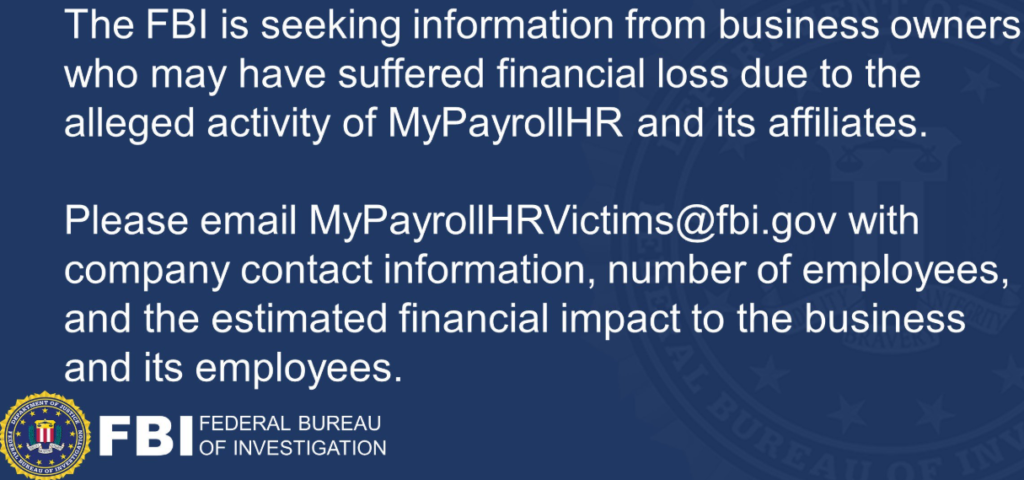

Cachet explains that they have suffered the charge for the $26 million transaction and that they too have fallen victims to MyPayrollHR’s exit-scam. Right now, the FBI is on the lookout for the CEO of the payroll firm, while New York’s governor has ordered the investigation of the company’s sudden and disturbing shutdown. None of the company’s employees are responding to any messages, while the parent firm “ValueWise Corp.” is equally unresponsive.

Source: krebsonsecurity.com

The other $9 million that were captured by MyPayrollHR come from “NatPay”, a Florida-based firm which was managing the taxes for the clients of the payroll company. NatPay claims that the notice of the freezing of MyPayrollHR’s bank account came after the requested payment was processed, so they too had their money stuck there. They are now trying to reverse the transaction, but at this point, it is not straightforward. This case highlights the lack of basic security and transaction confirmation in the traditional banking system. While MyPayrollHR is unlikely ever to enjoy the money they captured, this incident has caused a great disturbance to thousands of companies.

Do you have anything to comment on the above? Feel free to do so in the section down below, or on our socials, on Facebook and Twitter.