Hundreds of Thousands of Indian Bank Records Were Leaked Online

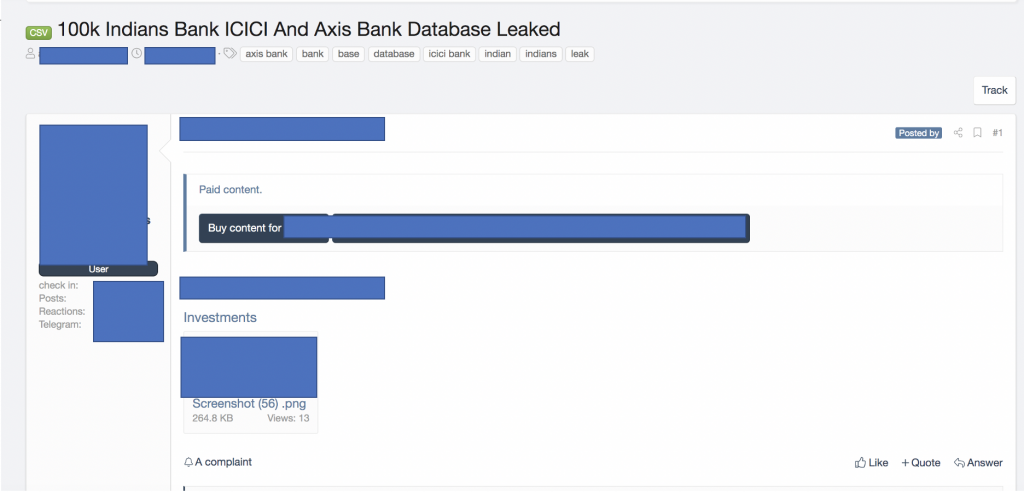

- Someone has posted 305k records belonging to Indian bank clients on a dark web forum.

- The records are shared freely and not sold, and it looks like it comes from a data aggregator.

- The banks haven’t announced anything concerning this, and they may not even know about it yet.

Cyble’s dark web crawlers have located an interesting leak involving the banking records of customers of the Axis and the ICICI bank. Both of these financial institutions are based in India, and the details seem to concern exclusively Indian citizens. The leak includes almost 369,500 records, which appear to have been aggregated from various sources and combined into two databases.

Roughly 30,500 of the records belong to Axis bank customers, while another 339,000 come from ICICI bank clients. Cyble’s researchers called some of the people in the records to validate the authenticity, and unfortunately, they have confirmed it.

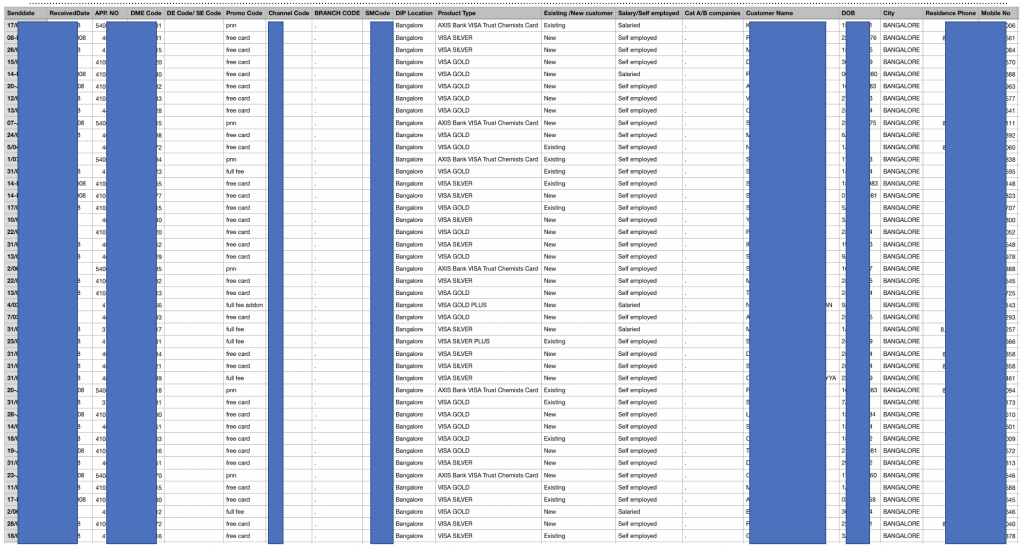

The information in the Axis bank listings includes the following details:

- Customer name

- Date of birth

- Mobile number

- Data Medium Exchange (DME) codes

- City of Residence

Source: Cyble

ICICI bank records have exposed the following details about the customers:

- Customer Name

- Date of Birth

- Credit card or Debit card number

- Account number

- Customer Address

- Customer Mobile Number

Neither ICICI nor Axis have announced a breach on their websites or social media channels, so the exposed customers are most likely unaware of the fact that such sensitive information has been leaked. By using the above information, actors could take things as far as identity theft, so taking precautionary measures right now is key.

Since mobile phone numbers are included in the lists, phishing calls and SMS messages with links to phishing sites are very likely.

Source: Cyble

We have reached out to Cyble for more details about the poster of the data, and they told us that the database is not for sale, but instead freely shared on forums. The poster is most likely naive, not fully understanding what he/she is sharing.

As for the banks, Cyble sees no evidence that there has been a hack on their systems, as the data looks like it has been collected by an aggregator. This still doesn’t make the situation any better for the exposed clients, though.

If you are a customer of either ICICI or Axis, you should check yourself on Cyble’s “AmIBreached.com” service to figure out if you are among the exposed clients. If you are, you should contact your bank and follow their instructions on how to protect your data and account. Finally, stay vigilant against all incoming communications and treat everything suspiciously, especially if it claims to come from your bank.