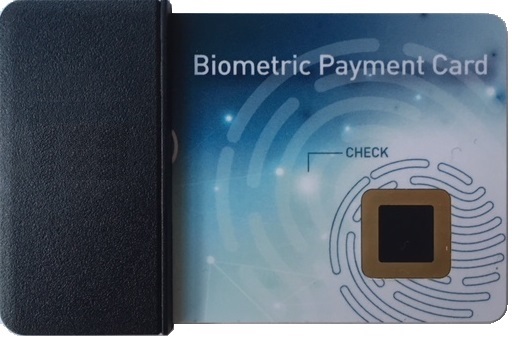

Biometric Credit Cards Using Fingerprint Scanning Are Being Tested in Scotland

- NatWest launches a biometric credit card testing program in Scotland.

- The bank wants to bring convenience and security to its customers, and fingerprint authentication is one of the ways they are considering.

- The maker of the card, Gemalto, believes that fingerprint credit cards will soon be everywhere.

The National Westminster Bank, also known as “NatWest”, has just launched a three-month trial of a state-of-the-art credit card that uses a fingerprint sensor instead of a PIN. The trial will be supported by 200 participants, customers of the Royal Bank of Scotland. There is no limit on the amount of the payments that can be carried out with these cards, and fingerprint authentication will be used for sums that go above the contactless transaction limit which is currently set at £30. Moreover, there will be no limits as to where the cards can be used, so they are suitable for ATM withdrawals, POS terminal payments, etc.

The customers register their fingerprint as a way of activating the card, and once it’s done, it cannot be changed in the future, just like the way PIN cards work. The fingerprint is not transmitted to the bank’s central system but instead remains locally on the card’s chip. Every holder transaction will be enabled by the locally encrypted data, allowing the user to swipe the card on the terminal and make the payment as long as they hold it with their finger on the sensor. This makes the card inherently safer against fraudsters, and obviously much easier to use.

image source: gemalto.com

NatWest’s head of payments David Crawford has made the following statement about the launch of the trial: “We are using the very latest technology across our business to make banking easier for our customers and biometric fingerprint cards are one of the many technologies we are exploring further. This is the biggest development in card technology in recent years and it’s great to finally see the cards in the hands of our customers.”

NatWest collaborated with Dutch chip-maker Gemalto, who has been developing this technology for quite some time now, perfecting and improving it for real-world application. Gemalto believes that fingerprint cards are not absolutely safe, but still much safer than four-digit PINs, and that biometrics for contactless payments is undoubtedly the way of the future. The Dutch chip-maker launched a similar test with customers of the Bank of Cyprus last year, so this new round of trials, which is the first in the UK, will be decisive for the technology. As for the infrastructure and customer mindset, not much needs to change, which makes the shift very feasible from every practical perspective.

Would you be using a biometric credit card instead of a PIN-based one? Let us know where you stand in the comments section beneath, and don’t forget to check our socials on Facebook and Twitter, for more news, reviews, interviews, and stories from the tech world.