Best Identity Theft Protection Solutions 2018 – Top 5 Services That Provide Full Protection!

Identity theft claimed the privacy of close to 17 million Americans in 2017 alone. There were a series of crimes related to credit card frauds, counterfeiting of social security numbers, and even full-blown impersonation attempts. All of that was more because of people’s lack of knowledge than their lack of resource. Fortunately, you can protect your identity in multiple ways - where modern software solutions take the first place. This is precisely why we'll talk about the very best identity theft protection solutions.

Best Identity Theft Protection - Top 5 Options for 2018!

We have taken a look at a large number of providers offering software solutions for identity theft protection. So, let's take a look 5 of the best options right now.

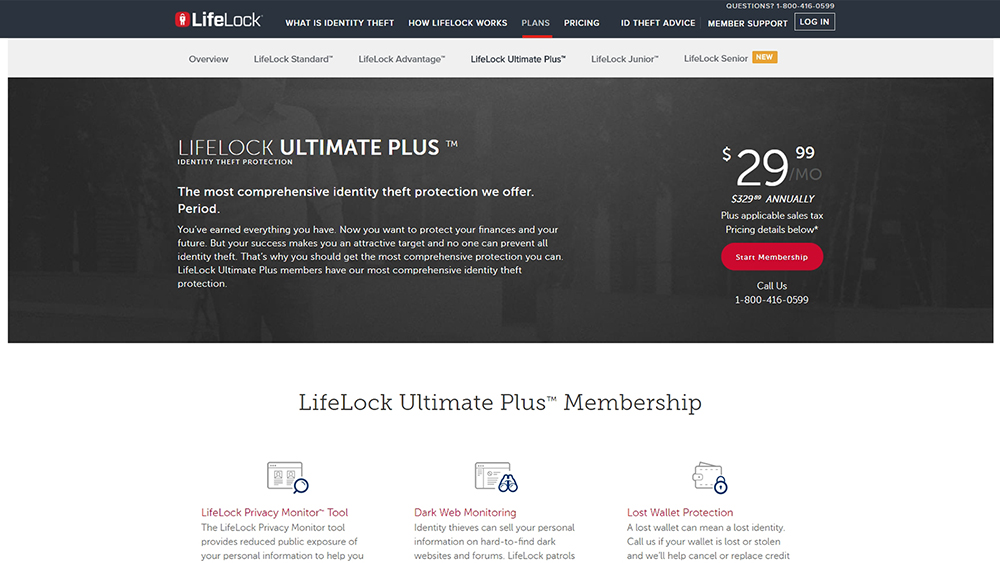

1. LifeLock Ultimate Plus - Best Overall Protection

Very recently, LifeLock also added a $1 million insurance policy against identity theft. This instantly brought the service on par with other competitors that were providing a heavy insurance cover. The company also promises to spend up to $1 million in application fees, legal fees, and other expenses that apply when restoring your identity. LifeLock Ultimate Plus is one of the priciest identity theft protection services you will come across. And for good reason – it provides comprehensive protection that includes precision-monitoring of your information (both personal and financial). It brings you credit scores and reports from all three major credit bureaus and alerts you frequently through email and SMS.

The top-level plan does cost you $29.99 per month. For the tag, it offers you tri-bureau credit reports and credit scores once in a month. You also get reports from the sex offender registry. Plus, LifeLock also sends you regular checking and savings account application alerts. The $1 million insurance is called “Stolen Funds Replacement” on LifeLock.

Besides the top-level features, you will also get access to a number of lower-tier features from LifeLock. These include essential checks like surveillance on black market websites and verification for a change of address. The company also offers the nifty feature of scanning court records. For a lower price ($9.99/month), you can get features like the LifeLock Identity Alert System, $1 million guarantees, and black-market-website-surveillance. At the moment, LikeLock Ultimate Plus promises the best mix of usability, alerts, and features to its customers.

2. IdentityForce UltraSecure+Credit - Best Budget Option

The credit summary by IdentityForce UltraSecure+Credit is quite comprehensive. It shows the monthly payments, total balances, and also highlights your unsatisfactory accounts. The report also gives you a credit history with all three bureaus. This is accompanied by credit report inquiries and contact info from the creditors.

The top feature highlights would be the anti-keylogging software and the credit-score simulator. However, the level of monitoring of financial activity falls a notch short of LifeLock Ultimate Plus. In addition, we would have liked it a lot better if it improved on its frequency of SMS and emails (it hardly sent us any). IdentityForce UltraSecure+Credit was a credible runner for the top spot largely because it provides decent protection for a thrifty monthly price. It brings to you monthly reports and scores on credit from all three major bureaus. And it combines robust protection of personal information with a bunch of uber-helpful utilities.

Just like LifeLock, IdentityForce runs through your credit cards and bank accounts for any suspicious activity. And connecting the service to an account is also super-easy. All you need to provide is the bank routing number along with the account number. IdentityForce could improve considerably if it also provided a transaction history for all the accounts. Also, the service does not alert you if there is a sudden, dramatic change in one of your checking account balances.

3. Identity Guard Premium - Strong Yet Pricey Contender

Identity Guard shows the tri-bureau scores on the home screen where you also see ratings like Good, Fair, and Excellent. When you click on the Details button placed under each score, you get a Credit Score Summary along with the date when the next credit score will be published. If the plan pricing sounds a little too steep for convenience, Identity Guard also offers an Essentials plan.

For $9.99 a month, you will get roughly similar advantages but without tri-bureau credit monitoring, public-record monitoring, and even credit bureau scores. The Total Protection Plan includes just about everything you get in the Platinum Plan. But the tri-bureau credit-score updates come quarterly instead of every month. On the sheer number of features, Identity Guard Premium would qualify as an excellent identity protection service.

Apart from the tri-bureau credit score that you receive once every month, there are some potent utilities. An anti-malware suite, anti-keylogging software, and a credit-score analyzer come bundled with the $24.99/month plan.

On the whole, Identity Guard tends to provide lesser detail than both LifeLock and IdentityForce. You don’t get a list of accounts that are either unsatisfactory or derogatory. Your credit history and recent inquiries with every bureau are also not populated.

But you get quite a few unique features found in Identity Guard. This includes registration for up to 20 credit cards and several bank accounts for monitoring. Registering a bank account is easy – you will just need the account number and bank routing number.

4. ProtectMyID - Limited to Experian Only

For viewing scores and reports after the first 30 days, you will need to purchase a report from Experian for $9.95 or a tri-bureau report for $31.95. It does not help that this is a one-time purchase. You will have to pay for another report if you want to see it say a week or two later. But ProtectMyID also comes with its fair share of positive attributes.

For example, it will send you an alert the moment it detects that a credit card was issued in the name of your child. It’s quite unsurprising that ProtectMyID monitors credit report by Experian to check if any major change indicates that your identity has been compromised.

Despite carrying an affordable price tag, Experian product ProtectMyID falls short of both expectation and competition. Unlike most other paid identity theft protection services that we reviewed, ProtectMyID levies a charge every time you want to see your credit scores and reports. The financial-activity and personal-info monitoring facets are also basic when compared to some other services.

ProtectMyID scans for your personal information on black market websites where credit card numbers are sold and traded. However, the service cannot be connected to the bank account and neither is large purchases monitored on the card. Large cash withdrawals are also not reported back promptly enough.

5. IDShield - New & Notable Option

If you are looking for a comprehensive identity protection package on a budget, IDShield gives you protection for the entire family at just $19.95.

At the moment, IDShield is monitoring pretty much everything between your Social Security numbers to new-address requests. This includes court record monitoring and credit card vigilance as well. The best thing about consultation on identity theft as a service is that despite many people wanting it, not many services seem to provide it. You can ask the experts just about anything regarding privacy leaks and breaches. Think of it as month-long consultation assistance for a one-time monthly fee.

In case of an identity compromise, an IDShield investigator will work on your behalf till your privacy is restored completely. The company will spend up to $5 million in such expenses. As we speak of the best identity protection services for 2018, we will hear a lot about IDShield.

At $9.95, it gives you identity and financial protection services for two adults. IDShield scores heavily because of its consultation services that pair you up with licensed investigators with minimum experience of seven years.

In addition to the regular features, IDShield ups the game with privacy monitoring for phones and even social media accounts. And we totally liked the free password manager that helps you secure personal information and credentials used on various web assets. Consider upgrading to the family protection plan that provides protection for parents and up to 8 children for just around $20 a month!

What Else to Know About Theft Identity Protection?

To make sure you fully understand the situation surrounding identity theft protection, we will provide some additional information. So, make sure to keep on reading.

Why Do You Need Identity Theft Protection?

One question that many people seem to ask is: is it worthwhile to pay for identity protection services? It is, given the number of instances where personal information gets compromised because of a data breach of malware attack. Financial information including credit card info must go through rigorous monitoring.

It is easy to receive a free credit card report. That way you will instantly determine whether or not each transaction was voluntary. However, it could take significant research if you want to know if an impersonator has opened another line of credit with your name, especially for a service if you aren’t using (or haven’t even heard of).

How to Find the Best Identity Theft Protection Provider?

The testing and rating of identity theft protection services were conducted keeping in mind their performance in five major areas:

- Credit report monitoring: It can be considerably difficult to manage all your credit card transactions simultaneously. An identity theft protection should generally take credit card monitoring into consideration, especially when there are inquiries related to a new plan or account.

- Tracking financial activity: Most business and service professionals find it increasingly difficult to track each transaction every day. In that, it becomes essential for the identity protection service to offer comprehensive financial activity tracking.

- Protecting personal information: Breach of privacy and access to personal information is one of the most common online frauds. It is expected of any good identity protection service to protect your personal information.

- Facilitating child identity protection: Of late, multiple crimes been committed by fraudsters impersonating children. And not many identity theft protection services seem to take this cue fairly seriously. We listed the one that does.

- Price: Compared to many other personal essentials, identity theft protection is a moderately costlier service. It could cost you anywhere between $10 to $30 per month. Plus, the lowest-cost option might not be the most viable because it would invariably miss out on a couple of key features.

We also looked closely into how much information each service provides about your credit report. It’s a plus if they also include your credit score because the free annual reports do not generally do.

Services that offered tools for the improvement of credit score were given some additional points. Services that lost points included the ones that did not publish credit reports for all the three bureaus – TransUnion, Equifax, and Experian. Also, it is not a healthy sign if services charge you a fee for showing your credit score.

Final Thoughts

If you do so much as small $5 transactions and fill in your name and address on the Web, you cannot run from identity protection anymore. Identity thieves are more desperate than ever. Making the right choice of an identity theft protection service will go a long way in giving them the boot!

If you feel your friends can make use of online identity protection, feel free to share our article on the social Web. And also, don't forget to follow us on Facebook and Twitter. Thanks!