AMD Announced the Acquisition of Xilinx for $35 Billion

- AMD to acquire Xilinx for $35 billion in an effort to complement and expand its portfolio.

- Xilinx is an expert in adaptive SoCs, FPGAs, and SmartNIC solutions, opening up a world of synergy opportunities.

- The chipmaker continues marching strongly in the field, with positive financial results and a strategic acquisition now.

AMD has announced the strategic acquisition of Xilinx, a world-class provider of adaptive computing and innovative cloud solutions. Xilinx is the inventor of the FPGA (field-programmable gate array) and Adaptive SoCs (systems on a chip), so versatility in large-scale deployment is what characterizes them best.

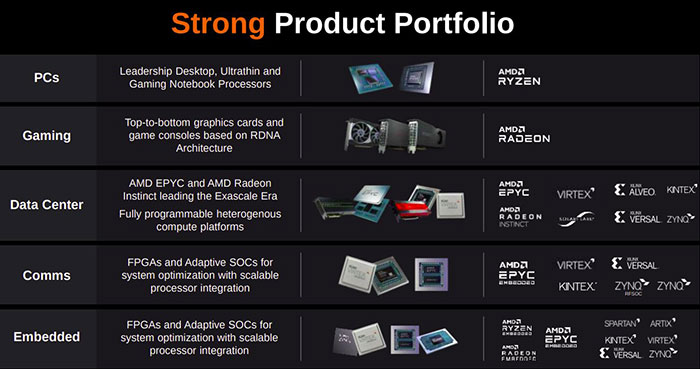

AMD has moved forward with the particular acquisition that will unlock their high-performance computing prospects for them, combining CPUs, GPUs, FPGAs, and Adaptive SoCs under a unified software layer. AMD is already having a strong presence in the data center, gaming, and PC areas, and with Xilinx, the company will be able to dive deeper into the communications, automotive, industrial, aerospace, and defense fields.

Related: Qualcomm Presents Snapdragon 750G With Global 5G Network Coverage

AMD President and CEO Dr. Lisa Su said:

Xilinx will bring 13,000 engineers and over $2.7 billion of annual R&D investment onto AMD, so a very strong move will take place in the tech field. The Boards of Directors have already approved the two firms’ acquisition, but the shareholders will also have to give their approval.

Finally, regulatory checks and approvals are also going to take place as required by law, so if everything goes well, the transaction will be concluded by the end of 2021.

AMD is betting on an explosion of synergies now, mentioning the figure of $300 million following the 18 months after the transaction goes through. The chipmaker’s portfolio will be extended greatly, and so will the revenue generation potential - and this is reflected in the acquisition cost. Remember, the amount is very close to what NVIDIA agreed to pay for the acquisition of Arm, and it’s reflective of the gravity of this agreement.

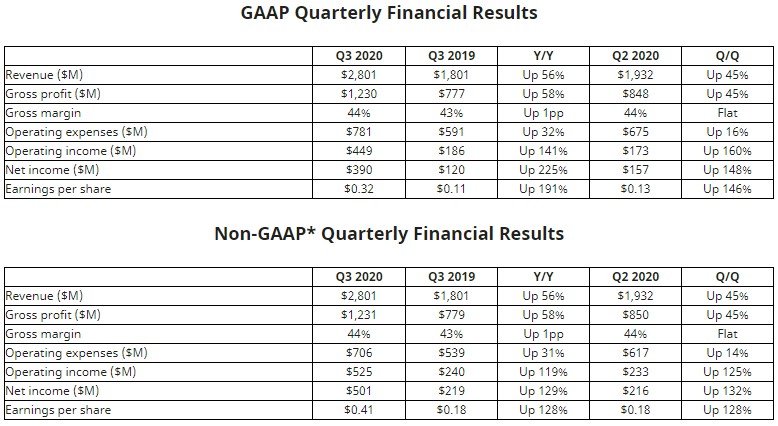

The Q3 2020 results that AMD announced today show a very positive picture of the company’s financial status, both on the quarter over quarter and on the year over year figures. AMD’s revenue was up by 56% compared to last year, and the net income rose from $120 million last year to $390 million this year. The firm just launched the Ryzen 5000 Series desktop processors based on the new “Zen 3” core architecture, which appears to beat Intel’s Core-i9 offerings, so everything is going amazingly well for them right now.