Paypal Alternatives 2018: 9 Smart Ways to Pay Online

PayPal is good, but if someone says PayPal is the best way to pay online, we might want to keep our wallets away from that someone. Being one of the pioneering online services, PayPal does host a lot of advantages for both its merchants and customers, but things are changing. The world where cryptocurrencies are dwelling for their share of the market, a cardless mode to pay has to pull their act together, and PayPal is apparently failing at that area, especially with the merchant accounts. PayPal charges about 3% of the transaction as the service charge. In addition to this, the bank charges a hefty amount to transfer funds, usually $10. These shortcomings are the reason why customers and merchants are migrating to PayPal Alternatives.

PayPal is also known for its compulsive freezing disorder, which compels it to suspiciously freeze accounts of merchants and customers with no prior warnings. The rule is simple; if PayPal algorithm detects suspicious activity, it automatically freezes the account along with the funds. Apart from that, the criteria to block accounts becoming pointless with each passing policy amendments. That’s why we have decided to zero down to Paypal alternatives that are both cost-effective and reliable. If you’ve struggled enough with PayPal, here is our list of 9 smart alternative ways to pay online.

1. Payoneer

Payoneer is one of the oldest rivals of PayPal and still comes first on the list for its rich features and customer friendly policies. Founded in 2005, it has managed to integrate itself with many big online players including Airbnb, Upwork, and Fiver.

Coming to the service, if you use Payoneer for bank transfers in a different currency, it clearly states on its website that it will charge up to 2% to make the switch apart from the other additional charges. The platform still has a free subscription policy, which makes signing up on the platform a smooth ride. Soon after you get started on Payoneer, you’ll be asked to apply for their Prepaid Mastercard, which you can load with funds within 2-4 days and use it for faster transactions. And the best thing is that anyone can use pioneer to transfer money to your account, even without signing up on the platform.

Payoneer is a well established, which is not hard to figure out with its presence in more than 200 countries. It also offers the support to over 150+ currencies and has more than 4 million registered users. The fees on Payoneer is reasonable and depending on the type of transfer. There are other variables which come into the picture if you use a service that has integration with Payoneer. With its wide availability, the benefits and savings are limitless.

2. Stripe

Stripe is designed to revolutionize the payment methods on e-commerce. And, if previously you have been using PayPal, it’s time to welcome the next generation e-commerce payment method. Stripe doesn’t put a cap on the withdrawal amounts, which means you’re free to get your money in whatever proportion you prefer.

The Stripe integration on a website is a relatively simple process and requires an SSL certificate and a content management service, which anyway are mandatory possessions of e-commerce platforms. This makes the integration a cake walk. Addition to that, users can make use of plugins and API to facilitate easy integration.

Another highlight of Stripe is their seamless customer support, which on average replies within the first 40 minutes. The smaller transfers are easier and cheaper on stripe compared to the ‘Giant PayPal,’ but for bulk transfers, it might be as expensive as its rival. However, the convenience of Stripe and its unparalleled customer support is worth bearing a few extra dollars.

3. Bitcoin

Well, Bitcoin is a relatively new technology, and many of the merchants might not feel comfortable with it. However, we can’t change the migration that is taking place in the market, and it clearly shows that today many people are switching to Bitcoin for the convenience and its affordable transfer rates. The other benefit that Bitcoin enjoys is its limitless transfers, which is why merchants love it.

Using Bitcoin is simple. First, buy Bitcoin in your - local currency and then transfer it to the recipient, who will receive the Bitcoins in his wallet - followed by converting it in his local rates.

Depending on the website you prefer, Bitcoin can be way cheaper than PayPal. Nonetheless, there are Bitcoin platforms that are not efficient regarding saving money. For merchants, the process to integrate Bitcoin wallet on their website is relatively easy and so is receiving payment. Merchants can directly get the payments on their wallet and can easily review it on the Bitcoin application. Comparing to platforms like PayPal, there are tons of factors that decide which mode of payment would be beneficiary to your business.

A little search on the topic might save you tons of money.

4. Skrill

Over the years, Skrill has managed to maintain its reputation for low-cost money transfers. It charges 1.9% of a transfer as a transactional fee between the Skrill wallets, which for the record is one of the cheapest rate available on the internet. Addition to that, Skrill’s prices do not differ for different countries. Skrill came on the market back in 2001, at the very beginning of the online money transfer era. This London based company efficiently supports more than 40 currencies around the world.

Skrill offers you a prepaid MasterCard which you can also use for your travel expenses. European citizens can take advantage of the Skrill Prepaid Mastercard to directly debit the money wherever Master card is accepted. Skrill has dedicated services for online betting and gamers which is refreshing for many users. It also has a VIP club with exciting perks and discounts.

Skrill also has a dark side, and it comes out during the international transfers for which it charges 3.99% on currency conversion. Overall the transfer cost might turn to 6% of the total amount, and it gets worse if Skrill doesn't support your currency. Adding to this horror, your bank may charge you for currency conversion for both withdrawal and receive. When we added all the figures, the disaster settles somewhere between 12-15% fee.

5. Xpress Money

Xpress Money is a cheaper version of PayPal that powers users to transfer between 165+ countries. It has a complex currency conversion rates, but you don’t have to do it manually as its currency converter will save you from the blunder. The fee primarily depends on the variables of your transfer: where you are sending the amount and your bank conversion rate. But, usually, it’s between 1-2 percent of the total amount.

There are some hidden perks too: if the amount is above the limit, Xpress Money does not charge anything to its user. For example, if you transfer anything above 300 dollars in Australian currency, Xpress Money allows the transaction for free. Isn’t that amazing?

Their exchange rates are competitive, and you can choose to receive it either through an agent or directly in your bank account or better, receive right at your doorstep. Even the transaction time is relatively fast and takes between 2-5 days depending on the type of the transfer you opt.

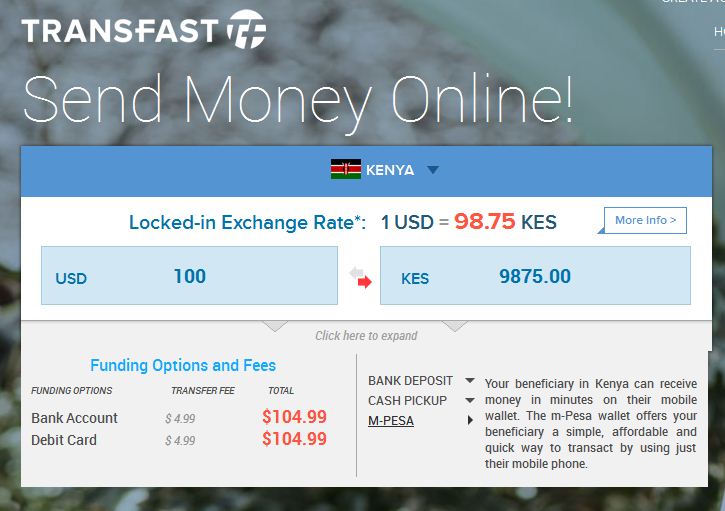

6. Transfast

Transfast is again a very empowering platform, and it lets you deposit the money right at your bank account. However, this feature is limited to the US Citizens. Yes! Only US citizens, who can conveniently use this to send money across the world. Nonetheless, Transfast supports 50 other countries, some of which are not supported by PayPal, apart from the US.

The good news is that Transfast prefers equality over confusion and charges a fixed $4.99 for all the transactions. Addition to that, it doesn’t charge anything on the transactions over $1000. Adding to this perk, Transfast features free transfer to some selected countries including Nigeria and India, where the majority of the world freelancers reside.

Similar to Xpress Money, Transfast also has a calculator to ease your conversion hassle.

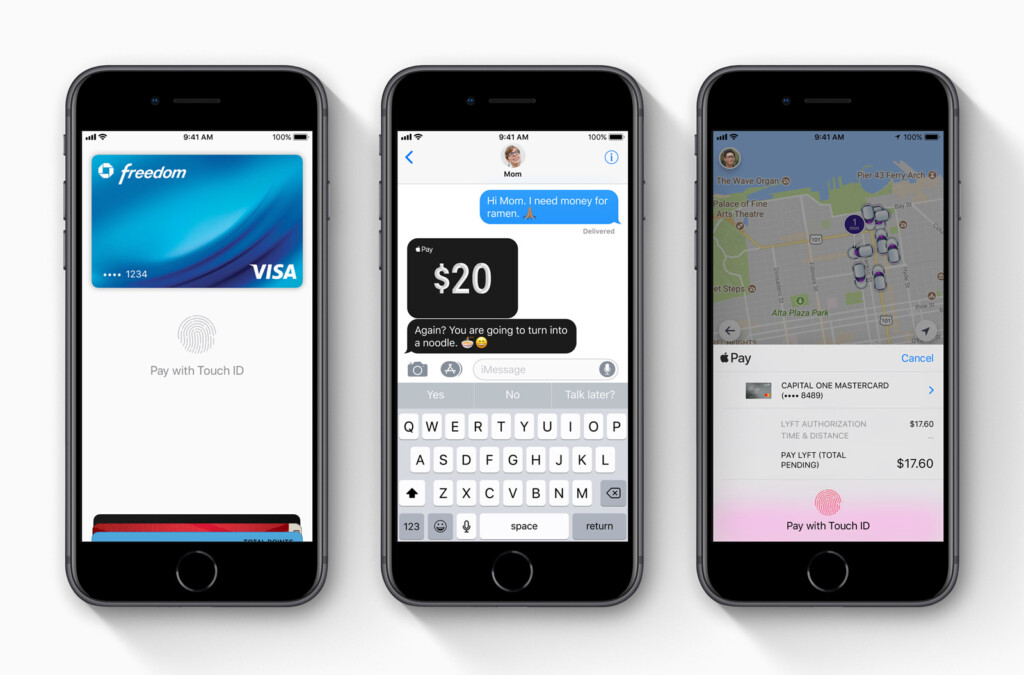

7. Apple Pay

According to a report from February 2018, Apple Pay has more than 127 million users. That’s a huge customer base, although the figure only accommodates 16% of the iPhone users. Apple Pay also has huge plans to expand their reach over the next 3-5 years.

As Apple Pay supports the transactions on its own products and devices, it is just limited to iPhone users, which is still a massive customer base, being the second most popular mobile operating system after Android. The service undoubtedly makes the transactions frictionless for its users.

Talking about the security, Apple is only available on iOS and as for now doesn’t have a desktop interface. The users can make the transactions through a line of products, including iPhones, iPads, MacBook Pro (using touch ID or passcode) and through Apple watch. Apple Pay securely uses inbuilt hardware to store your card details, and it claims that it doesn’t store any part of the transactions in their system, which sounds too secure to be true, but let’s believe on their website.

To use Apple Pay, users must have a merchant account, and the business must abide by its guidelines. However, there is a catch. Your website should include Apple Pay as one of the options in case you have multiple payment alternatives and must make it a default payment option if the user has an active card. Apple Pay automatically saves the received amount in its Wallet which can be spent using Apple Pay or can be transferred to your bank account. The transfer usually takes around 1-3 business days.

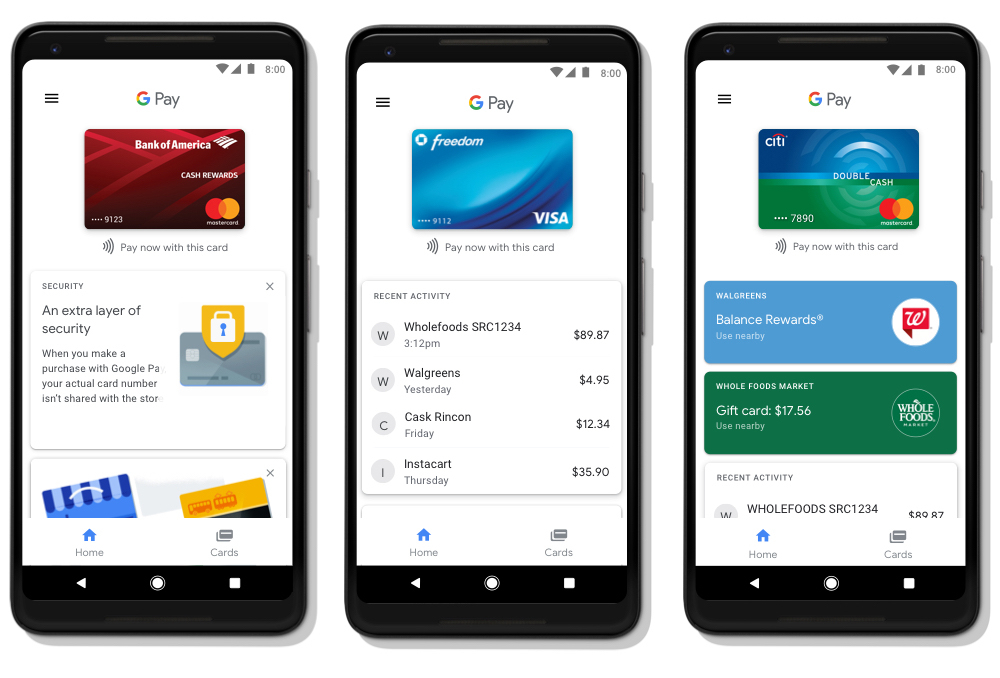

8. Google Pay

Google Pay is the most practical Paypal Alternative and focuses on consolidating the existing Google services to offer a reliable payment option. Google Pay is available on both the iOS and Android. The integration of Google Pay on a website is done via API which is more straightforward than any other payment option available on the internet. It also enables merchants to add and run loyalty programs and reward tracking system. It also doesn’t involve a sign-up fee for a merchant account.

Since the majority of the Google phones run on outdated Android versions, it limits the users to adapt to this relatively new service. Also, Android rules over the low and middle-end users who do not subscribe to online bank transfers as much as the high-end Apple users. This explains why Google Pay is only adopted by 5.3% of the total smartphone users.

Talking about security, Google Pay encrypts the customer’s card data before any transaction. The encryption effectively limits the risk of breaches. It usually takes 2-3 days for a transaction to complete, which is relatively fast compared to some of the other options on our list. Google Pay is most popular in the UK and US.

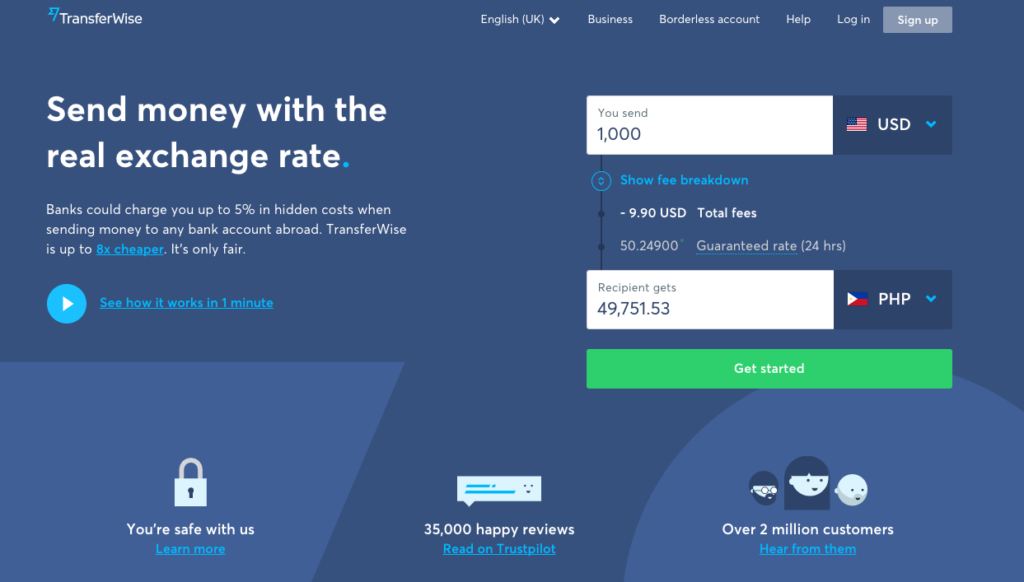

9. TransferWise

TransferWise is one of the best Paypal alternatives for international transactions. The reason behind its wide popularity is its low fee and reasonable mid-market exchange rate. It charges standard 1% of the entire amount on all the bank transfers. This rate is about one-third of what PayPal charges its customers. This awesomeness is added with its mid-market exchange rates which are undoubtedly the best rates available on the internet.

The transfers are directly deposited into the receiver's bank account and the processing time is super fast. Although the service states it takes between 2-4 days, reviews from the long-term customers make it clear that it doesn’t take any more than a day.

TransferWise also provides an excellent solution for businesses and has a Borderless account feature that merchants can take advantage of. The fee structure of business account is the same as personal transactions. It also features a full-fledged dashboard for transaction management between multiple currencies. Addition to that, it also supports automatic payment.

Final Words

We sincerely hope that this list helps you to find a cost-efficient and reliable PayPal alternative. All the solution on our list has their own set of strengths and limitations. Check them for your requirements and settle for what suits you and your business the best.

Do you agree with our list or did we miss your favorite money transfer solution? Do let us know in our comments. We would love to read your opinion. Also, to get instant tech updates, Follow TechNadu’s Facebook page, and Twitter handle.